What Is Around The Corner? Macro Round Table

2023

Review:

In the last substack that I wrote, I went over my thoughts on a continuation of this bear market and why it will continue. I will cover my most recent findings today.

Liquidity: Where is it coming from?

Money is still finding its way into the market from China QE (money printing and fiscal stimulus) and the US TGA Account (Treasury General Account)

TGA: Fiscal spending increasing (account value lowering)

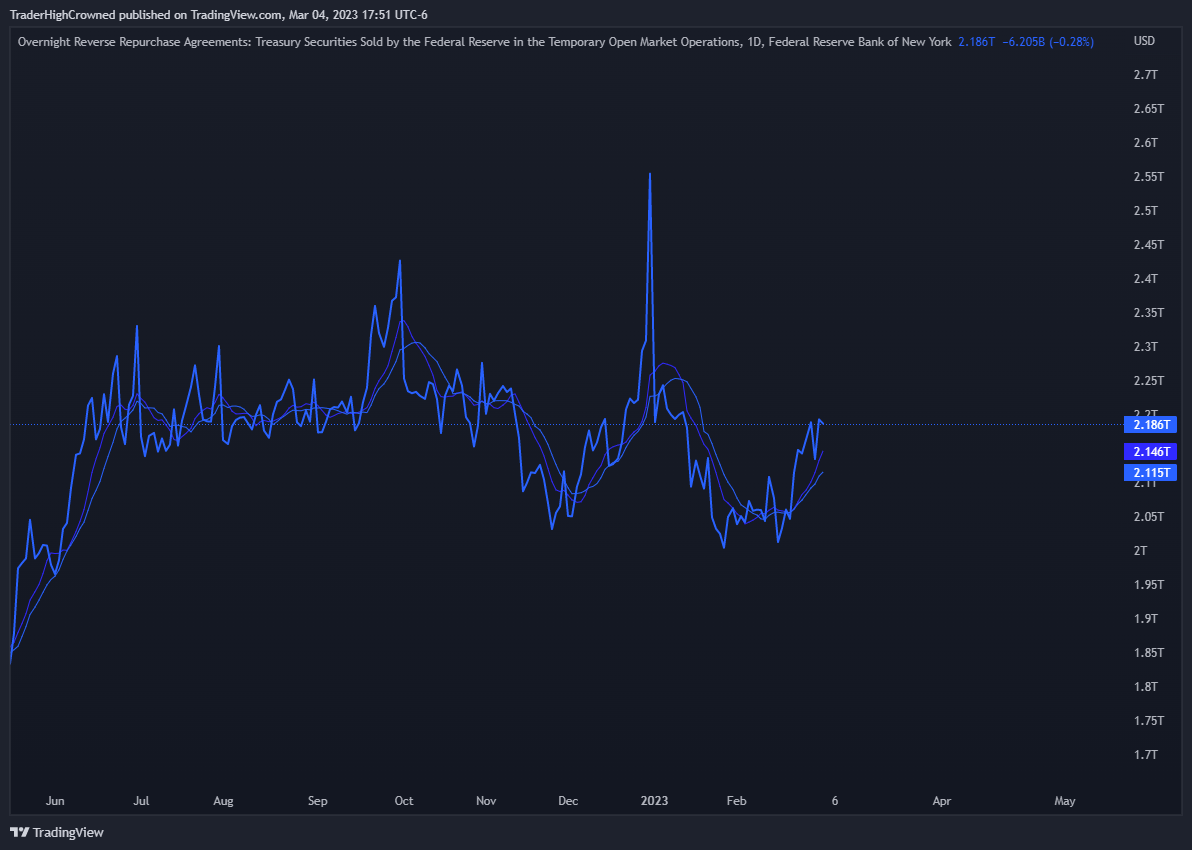

Reverse Repo Market: More liquidity being drained from markets into Federal Reserve for yield (4.50%)

S&P500 Futures: A lot of volatility and confusion

US 30 Year Bond Yield: Defending A Key area

Bitcoin: The Global Liquidity Sponge and Future Internet Currency/Blockchain Technology

My Thoughts: We are in a very unique situation

The direction of the market is decided this week with Powell’s testifying, CPI next week, and FOMC later on. I am siding on the short side. I STILL SEE ONE MORE LEG DOWN IN RISK-ON.

Second, Banks are requiring higher down payments for investment properties. Instead of 20/80, it is now 40/60 (40% down, 60% loan) because of Debt Service Ratio requirements. This is a big deal which will push investors away from buying cash flow properties while prices are still generally high.

Banker says that people are flooding to Money markets and the Treasury Market. People went their yield that has not been available for over 10 years…But is the opportunity cost a rally in risk-on assets? I don’t think so.

Aka is this a 2019 situation where hidden liquidity allows markets to rally in the face of recession? THIS IS THE REAL QUESTION

Sentiment is fully ready for the Fed to raise rates another 100 BPS to 5.50%. I understand, and I would not be surprised to see it. What most people are not ready for is yields dropping before Terminal Rate is hit, risk-on selling off, and while everything is looking like shit (macro fundamentals).

I believe the bond market yields have topped and Federal Funds Rate can go higher.

Now do not forget, all these opinions do not dictate how I trade on a daily or weekly basis. These are large forces at work and take months and years to play out.

In my opinion, we will seeing rallies in both bonds and risk-on before shit hits the fan.

I will continue to repeat this, markets are constantly out of balance to force players in or out at the worst times. Be ready for anything, but always have skin in the Long Game.

Follow my twitter for more active news and day trades. FYI IS IT NOT FUNNY THAT GOLDMAN SIGNALS AAPL 0.00%↑ AS A BUY TODAY?

Cheers,

traderhc

Disclaimer: This is not Investment Advice. Any content here is for educational purposes only. All trademarks and copyrights on this page are owned by their respective parties.