Tariffs Are Back In Style

New Greenland tariffs on EU

Recap:

Equity indexes (QQQ SPY IWM) have been in melt up mode since April 2025. IWM has recently broken out from a 5 year range into price discovery. Overall, the market is starting to broaden out. 2026 will be a year of strong rallies alongside periods of volatility.

Tariffs did not crash the US economy.

Relevant Topics, News, and Data: Week of January 19th

New 10% tariffs announced on 8 European countries over Greenland (starting Feb 1, rising to 25% June 1)

New York Stock Exchange announces new tokenization platform

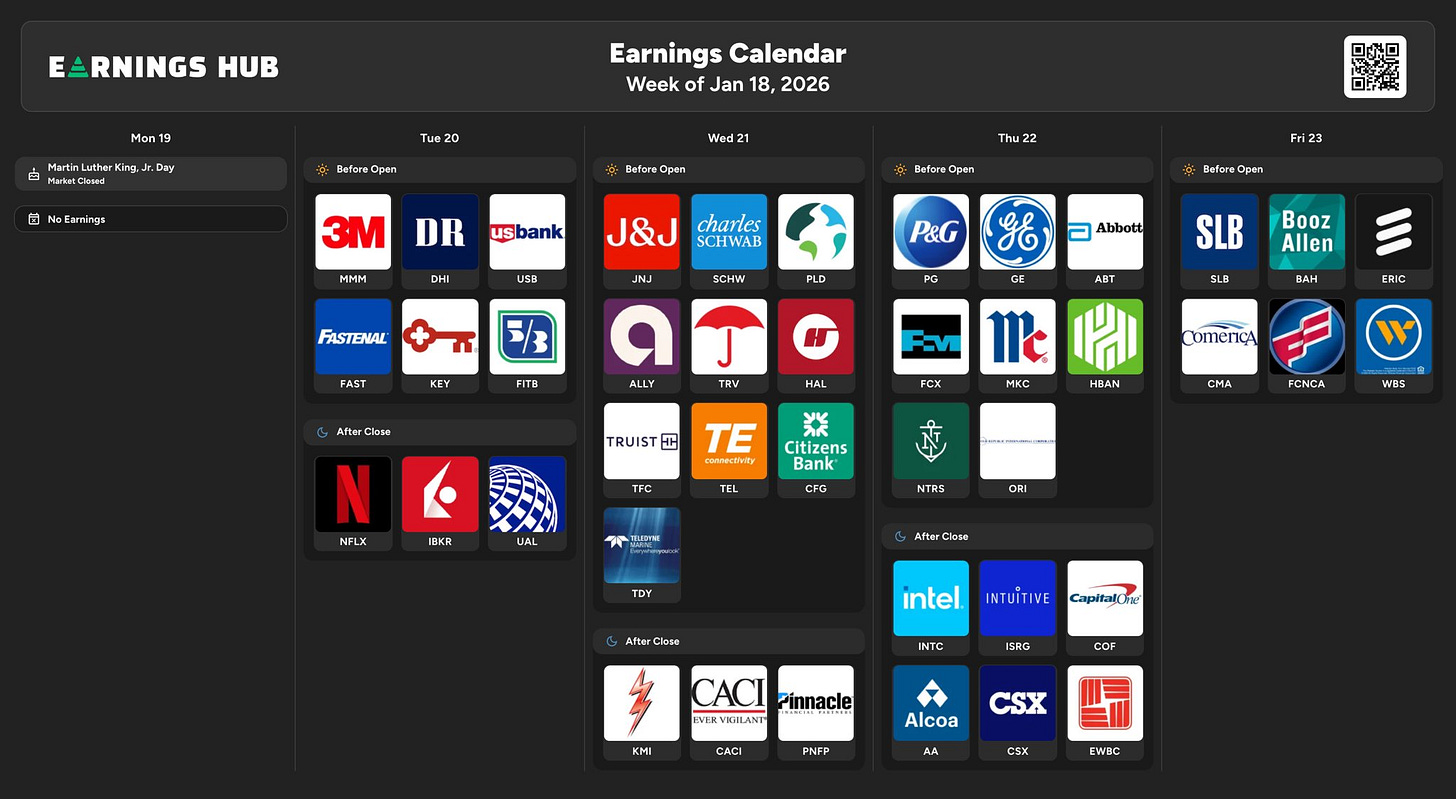

Earnings kick off with NFLX 0.00%↑

Institutions continue to buy MSTR 0.00%↑ which is in a severe drawdown from ATHs

ETH hyperliquid whale continues to hold a $880m leveraged position with majorly ETH

CLARITY / Bitcoin ACT not passed yet, continues to be pushed back

Government Shutdown Jan 30th