Tariff Day Fear

April 2nd

If you only want to join *ONLY* the discord, here is the link. Neal’s tradingview indicators and scripts are for sale on there too.

Whop Link for discord access only, Neal's indicators, and Educational Course

Recap:

Equity Indexes trade sideways within a range the whole week of 3/21 OPEX.

Relevant Topics, News, and Data: Month of March

Tariff April 2nd (zero clarity on exactly what is being tariffed)

Land to be opened for development

Trump Tweets for rates to be cut by Powell after March FOMC

US government plans to buy BTC in a budget friendly way…possibly by issuing bitcoin bonds

Ukraine ceasefire yet to be determined

Congress has not passed any debt ceiling raise or fiscal stimulus (only averted government shutdown and is funded for 7 months)

Powell switches his tone back to pre-Dec. 2024 FOMC (calls Umich data an outlier, downplays Tariff inflation, cuts QT by half again leaving $5b treasury rolloff and $30B MBS a month, and reaffirms “wait and see” approach)

EU cancels retaliatory tariffs, Mexico sends Trade Ambassador to US, Mark Carney promises to work with Trump

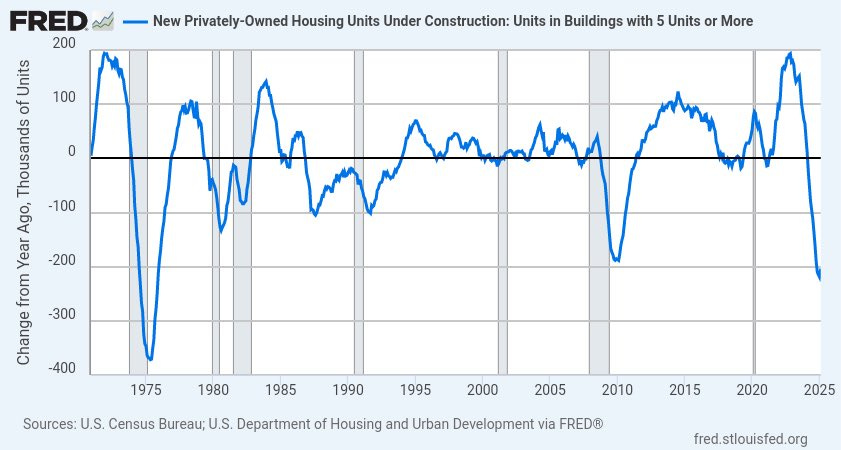

Apartment buildings 5 units or more are in deep correction showing the extend of the current housing recession

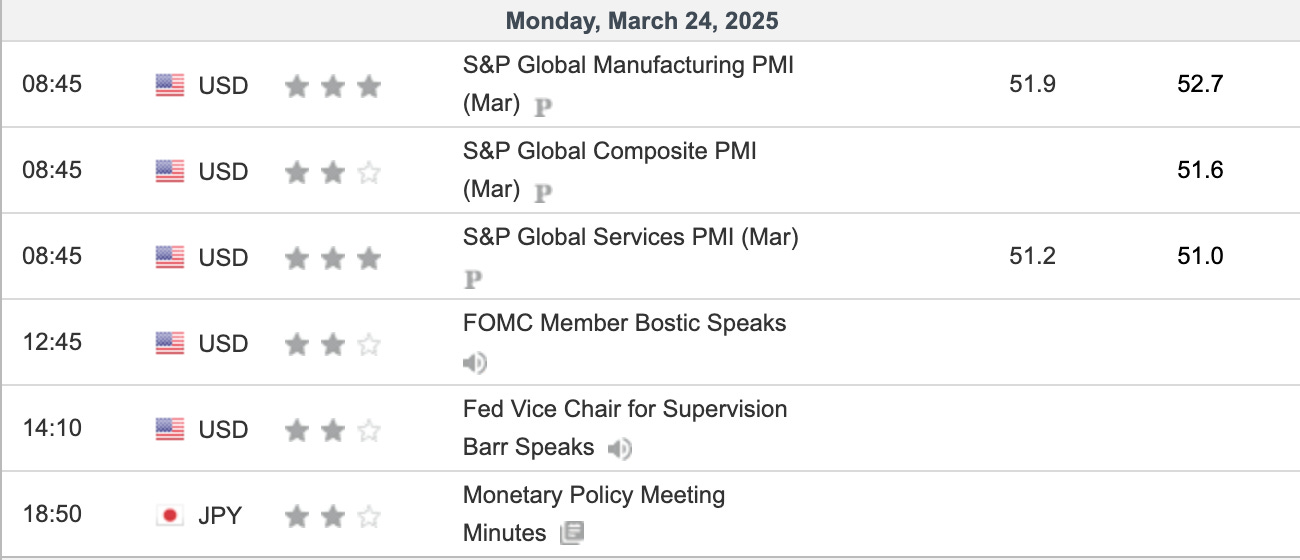

Quarter End Week will be fueled by positioning for Tariffs April 2nd (next Wednesday), PCE Friday, PMI Monday, and Housing Data/Core Durable goods Tuesday, Wednesday, Thursday.

We have the possibility to hear updates on Tariffs at will by Trump or other countries as the deadline approaches. PCE will be an important read as it is the Fed’s main inflation gauge. If personal spending comes in strong, that could be a positive for markets as consumers are still spending.

Nasdaq and S&P are hovering around correction territory -10%. Typically in a strong market, this would be the full extend of the selloff. Depending on what Trump wants (lower rates) will decide where we go next. Another leg down in the market could cause Powell to cut rates as yields dive and change FFR forecasts and rate probabilities for future FOMC meeting.