OBBB meets the TACO Trade

"Trump Always Chickens Out" Buy The Dip Trade, but new money is flowing now

If you only want to join *ONLY* the discord, here is the link.

Recap:

After about two weeks since the OBBB, QQQ 0.00%↑ SPY 0.00%↑ chop sideways near ATHs as the summer volumes and a low volatility environment plays out before earnings start to heat up.

Relevant Topics, News, and Data: Month of July

Canada / EU 30% tariffs go live Aug. 1st (Canadian goods USMCA exempted)

Congress working to pass the “Clarity Act” after the “Genius Act” both focusing on digital assets

Pentagon invests billions into the first US rare earth mine since Jimmy Carter

Copper tariffs 50% on Aug. 1st

Grok AI (now #1 AI globally) goes live in TSLA cars

$BTC surges near $120k after the OBBB became law July 4th

Institutional players step into accumulating $ETH via ETH company treasuries

Labor market data remains resilient, pushing US rates back up after the treasury market rally into the OBBB passage TLT 0.00%↑ SHY 0.00%↑

Real estate continues to be “frozen” in 2025 due to multi-year high rates

Commodities-excluding gold breakout of a big base on index chart (Copper being a main focus)

TSLA 0.00%↑ to open its first store in India this Tuesday

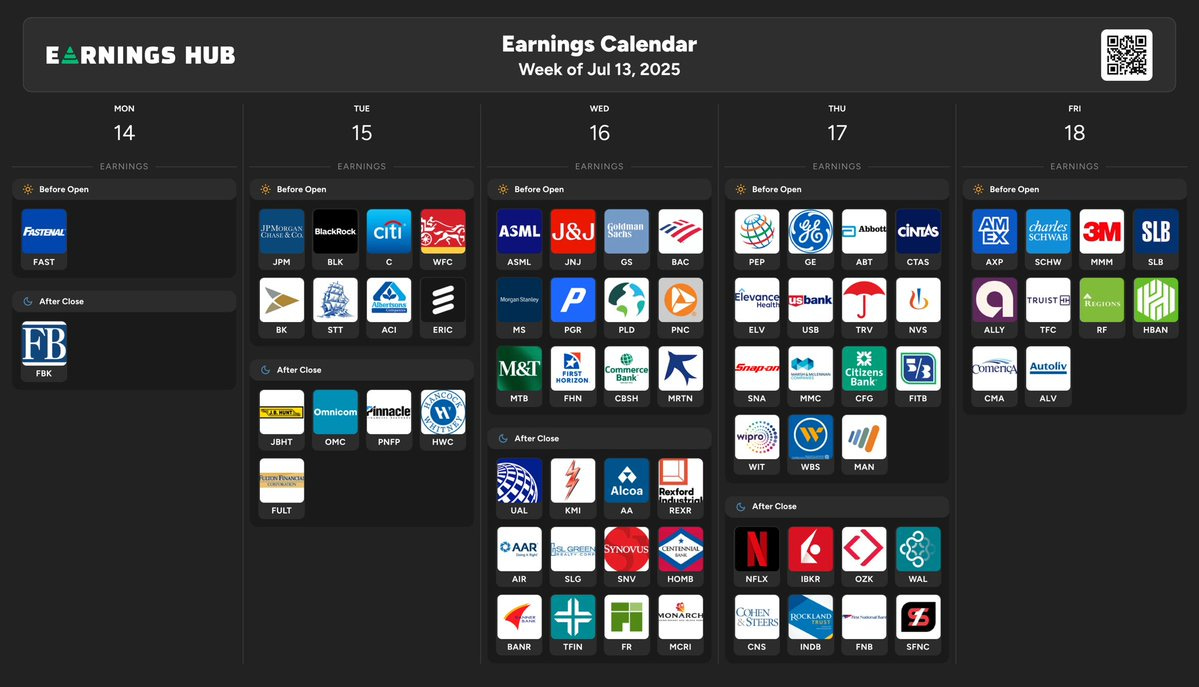

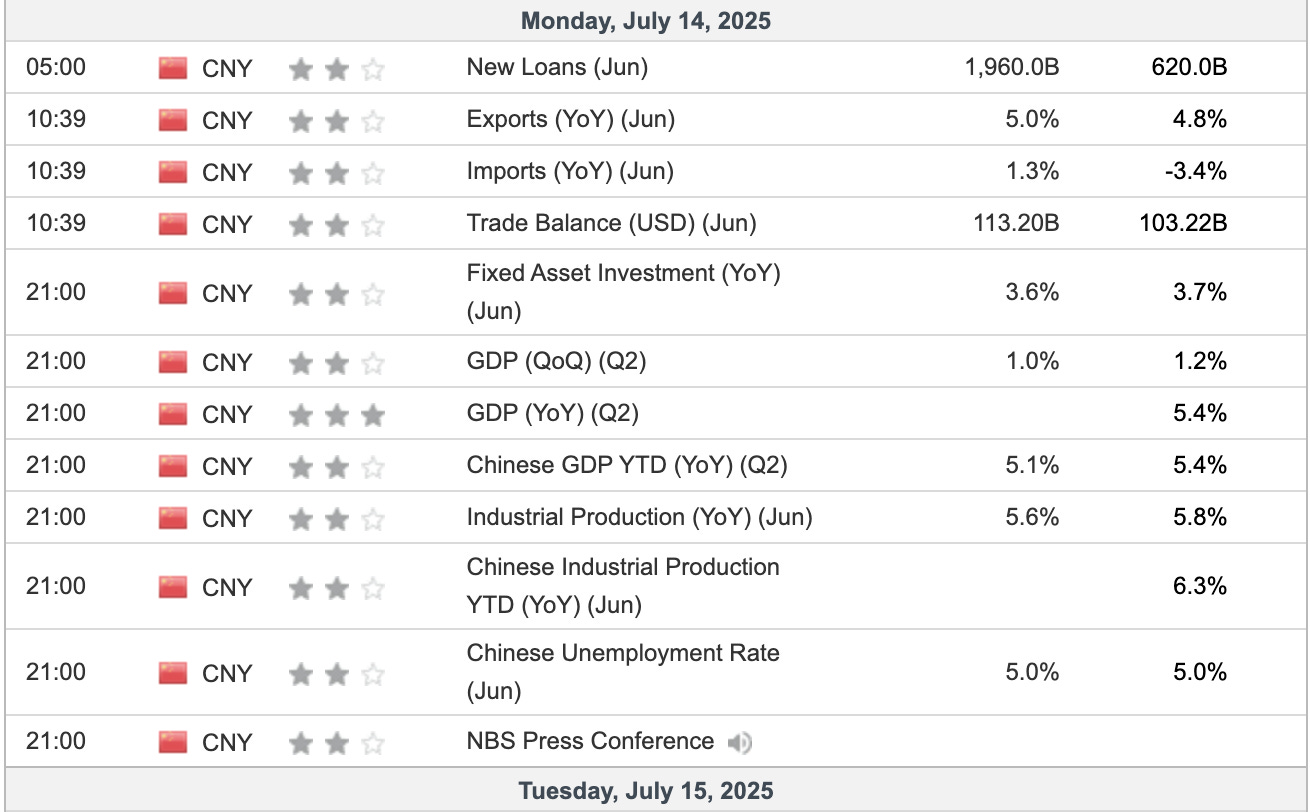

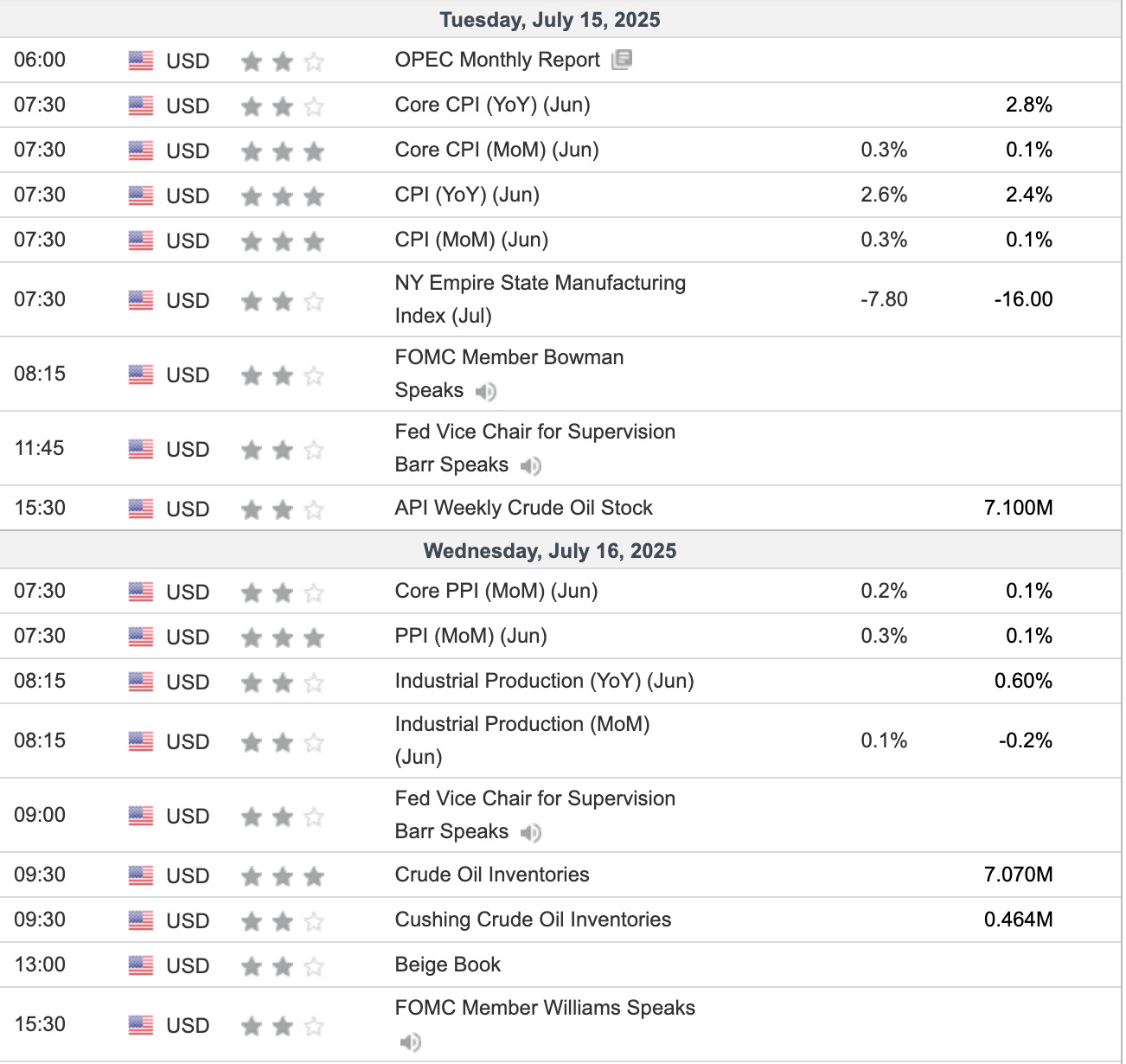

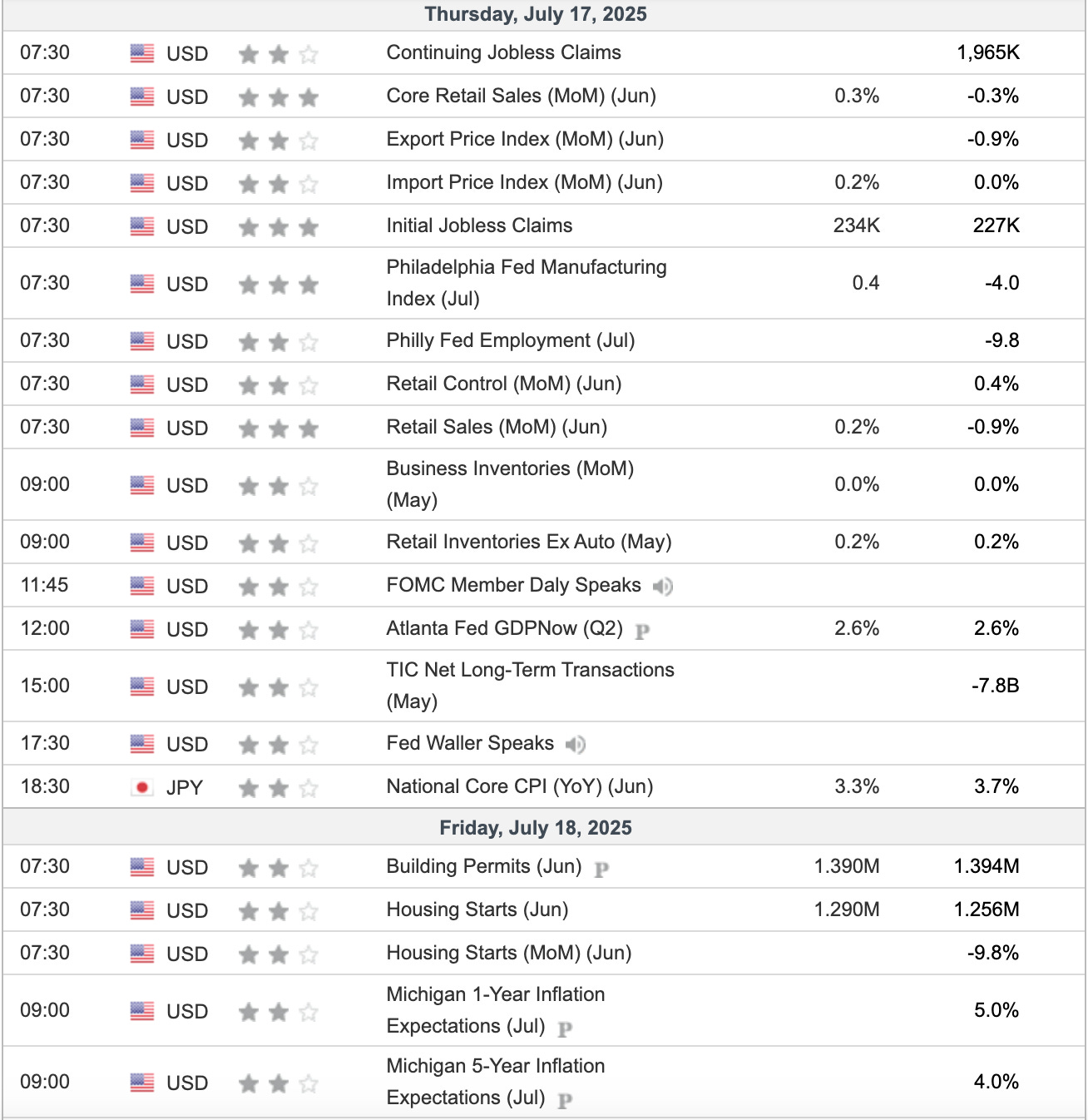

Here comes monthly expiration week (MOPEX) with earnings kicking in. Banks, Financials, and NFLX 0.00%↑ are reporting this week. Notable economic data will be CPI/PPI, Retail Sales, Labor Market data, and Housing data.

TACO trade has been the BTFD narrative since April low. Now that the spending bill (OBBB) is law, we are going to be looking for Trump to strengthen his stance on tariff negotiations since he has a cushion of new money flowing into the economy.

The key signs for a local top in QQQ 0.00%↑ SPY 0.00%↑ IWM 0.00%↑ will be covered below.