Market Operators and the Cost of Capital

Bessent, Trump, and the Admin

If you only want to join *ONLY* the discord, here is the link.

Recap:

Equities and Risk-on continue to melt up as Funds are under-positioned, Hedge Funds squeezed on record short position sizing, and retail buying heavily.

Relevant Topics, News, and Data: Month of May

India Deal nearly completed (less than 7 days away reported)

Japan Deal moving forward

EU comes to the table after Trump raises tariffs on before memorial day weekend (rolled back as EU comes to the table)

BTC Strategic reserve passing a few states to become law

One Big Beautiful Bill passes the house, senate to vote on it beginning of June.

US Yields expected to set highs and start to trend lower stated by traders

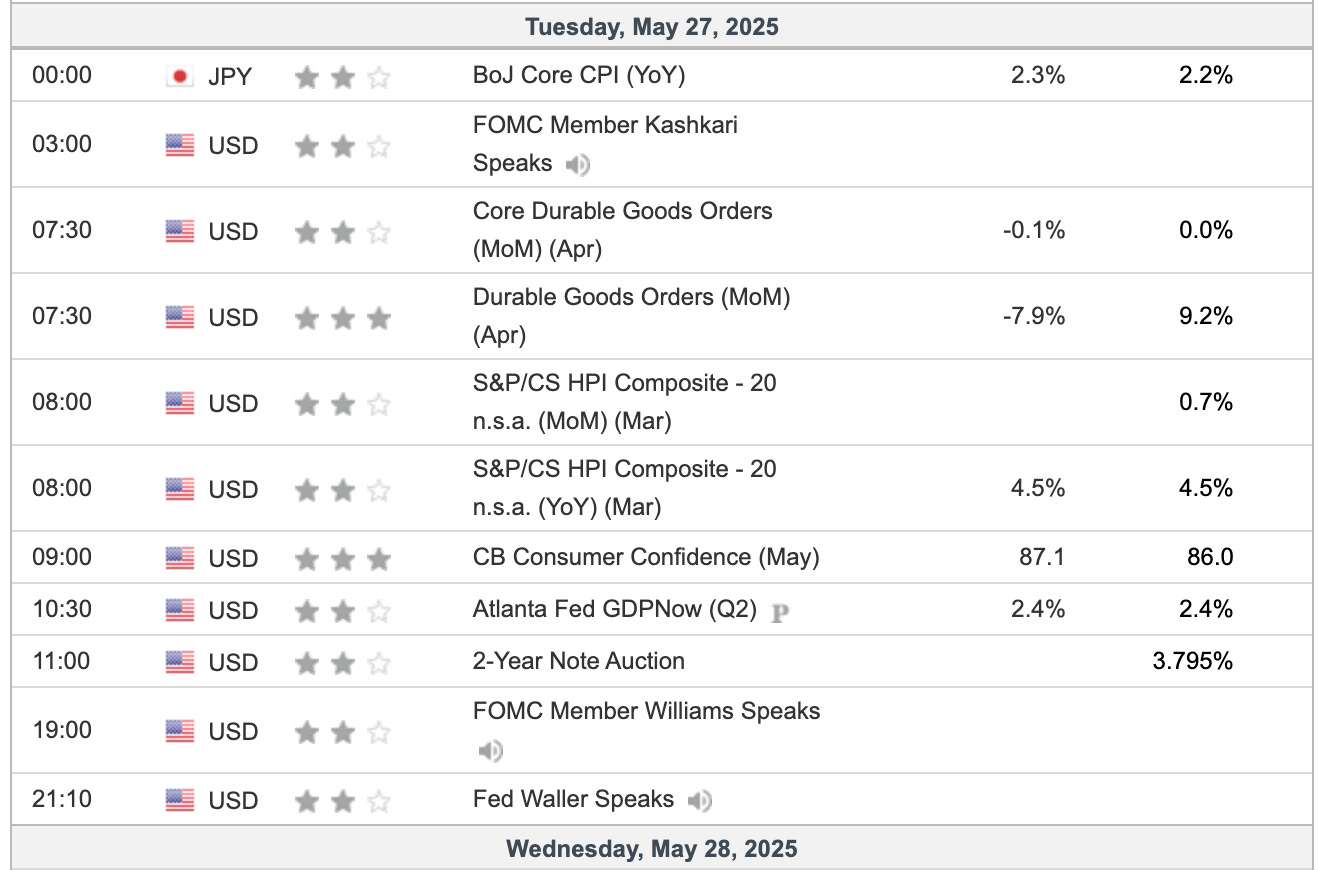

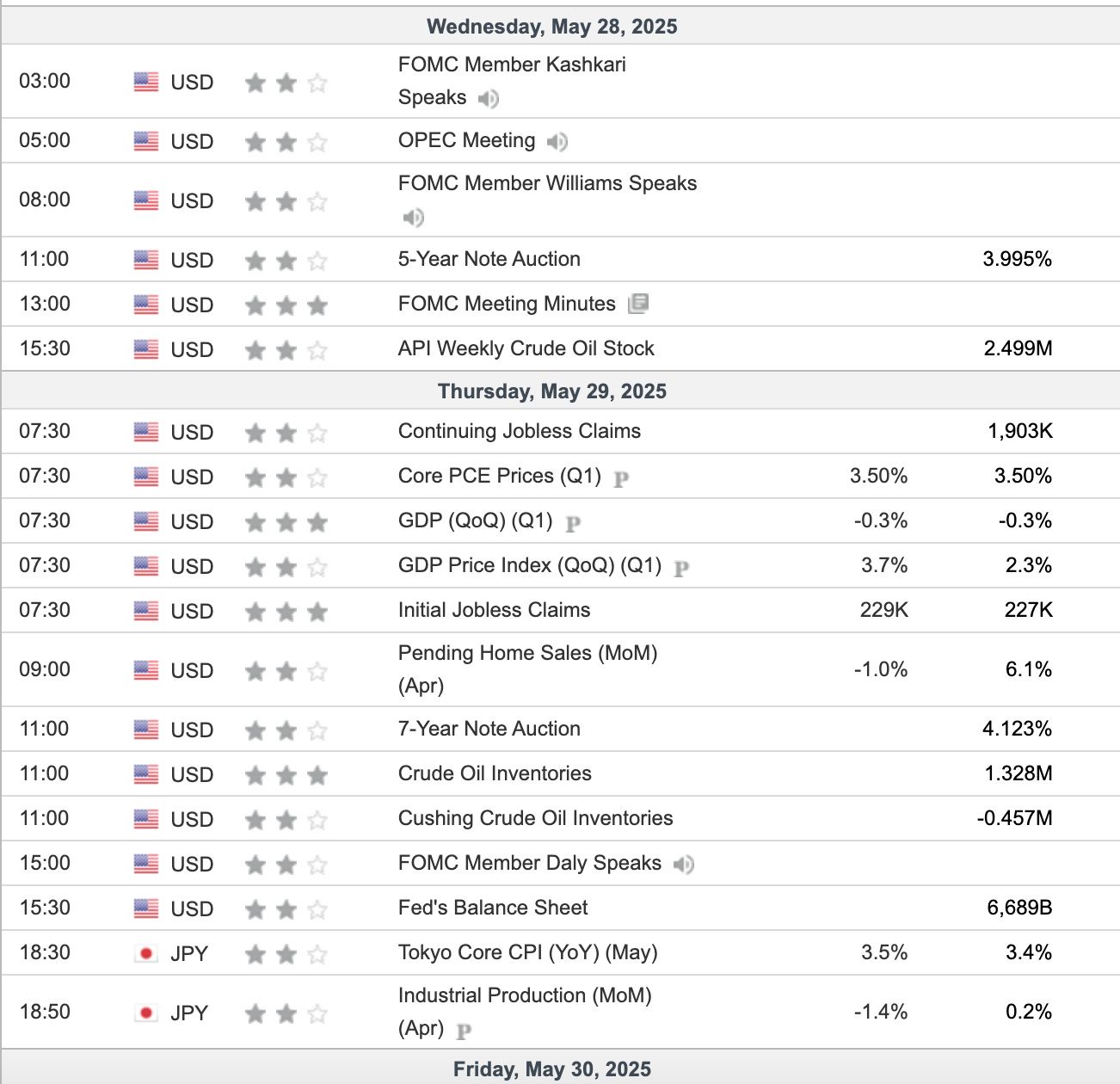

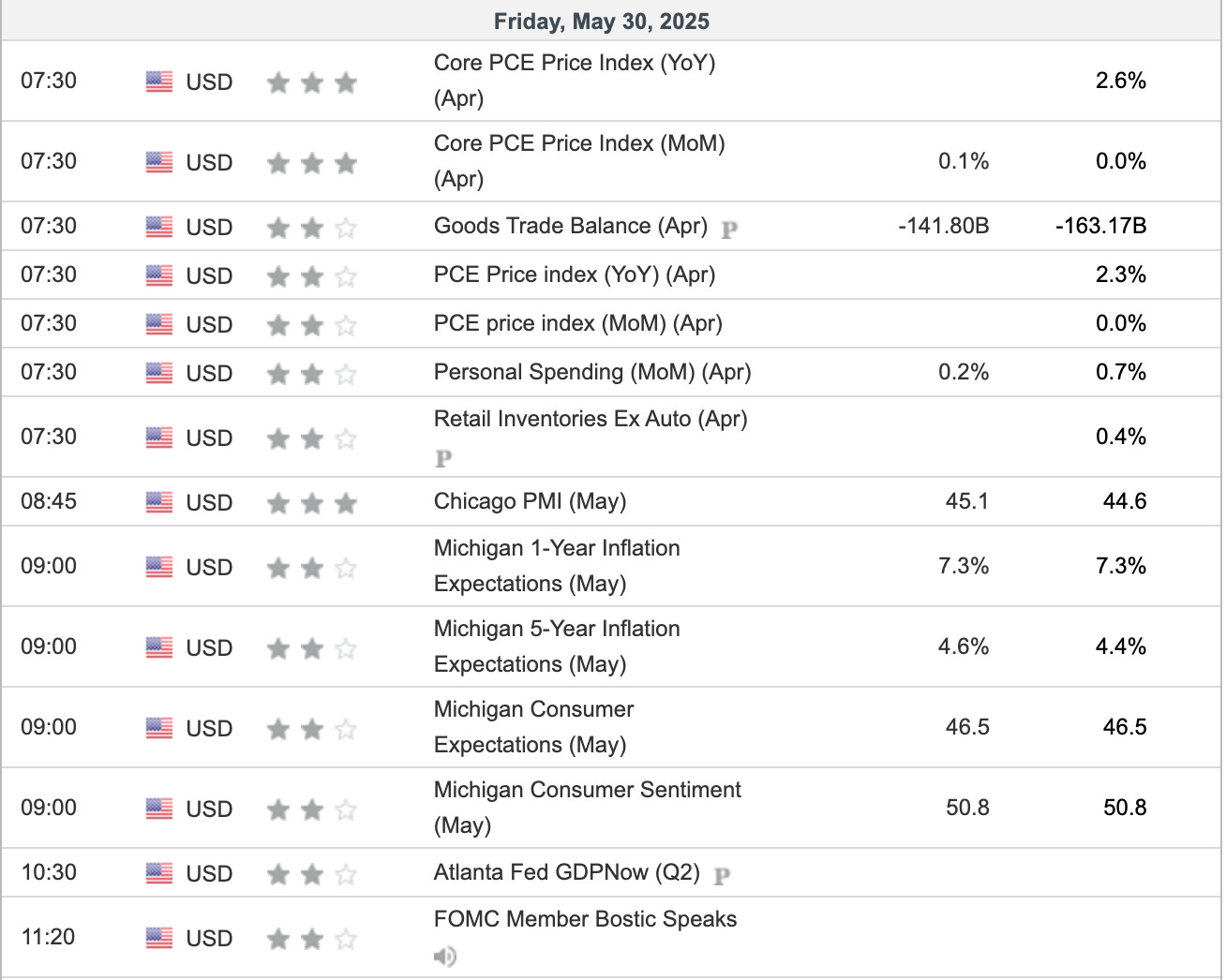

Durable Goods, Consumer Confidence, FOMC minutes, PCE, and GDP update.

Over the last few weeks, we have seen the market operators kick into “positive” talk and results. Most of the important Tariff Trade deals are in good standing and moving forward. Like I stated above, price action is largely driven by imbalances in market participants.

After a record rally off SPX 4,800, we are starting to see the beginning of a lower velocity rally as pullbacks come to short term SMAs, and the dip buyers step in while good news comes after.

We went from Recession talks to the tariff uncertainty unwinding into talks about melt up like late 1990s. Many statistical bullish signals fired the last month or so which lines up with my 2025 thesis.

Volatile during an overall bullish thematic year.

(deep dive today in the conclusion section of the substack)