Energy And Economic Expansion

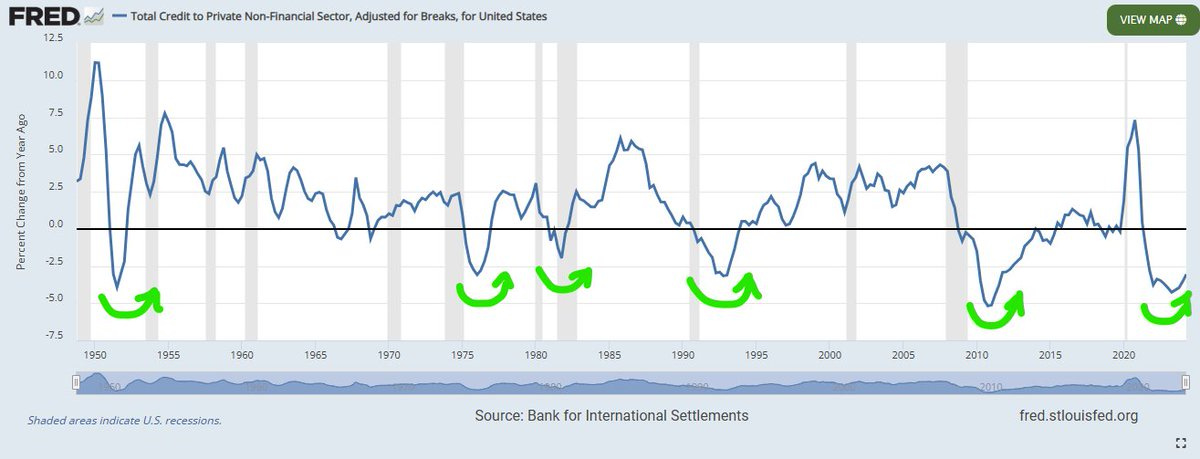

Credit must be created now

Relevant Topics, News, and Data: Month of December

Texas fully capable of passing the formalized Bitcoin Strategic Reserve (BSR)

Putin and Trump both want a BSR (Bitcoin wars)

Japanese lawmakers push or BSR

MSTR to be added to QQQ

Tons of opinions on this and people don’t do their homework, His leveraged loans are fix and convertibles. The So-called margin call on BTC price is so low, and he would just collateralize more of the bitcoin or cash to cover the loan! This has been known for years. The whole financial system would have to collapse for him to be margin called!

Quantum computing comes back again, no it will not decrypt Bitcoin, still needs another 100 or 1000x computing, and BTC can be upgraded

“It’s going to take time to transition the world to a decentralized financial system. Judging by market cap, we’re less than 5% of the way there.” - Naval

FOMC Wednesday, 25 bps Rate cut 95% baked in

MSFT votes no on BTC acquisition

TSLA ATHs

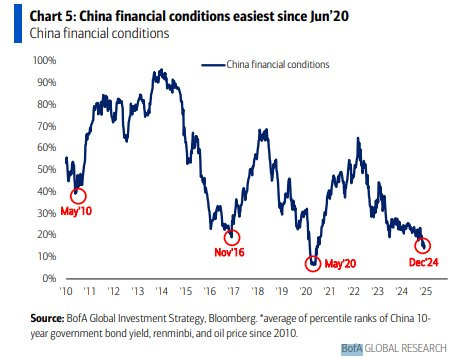

China Stimulus is still in limbo

US Small Business optimism is highest in years

The best signals right now for the overall economy still is seeing energy get a bid (WTI to 78, now 70,) and China executing a real deal stimulus package. If you look at US building permits, it seems like its been in a trough for the last two years. With US small business optimism surging with Trump and Elon taking hold, we should see many pro-business advances and de-regulation. This continues to be a massive catalyst investors do not want to accept. The possibility of a soft landing could be achieved and a recession/selloff in the markets could be pushed off until 2026.

I am still looking for housing data to rebound as it has suffered the last year. Remember, there is no recession without a housing recession.